Gerlach Prepares Customers in the EU and UK for the Post-Transition Period

29. July 2020Hamburg’s Logistics Sector Severely Affected by the Coronavirus Crisis

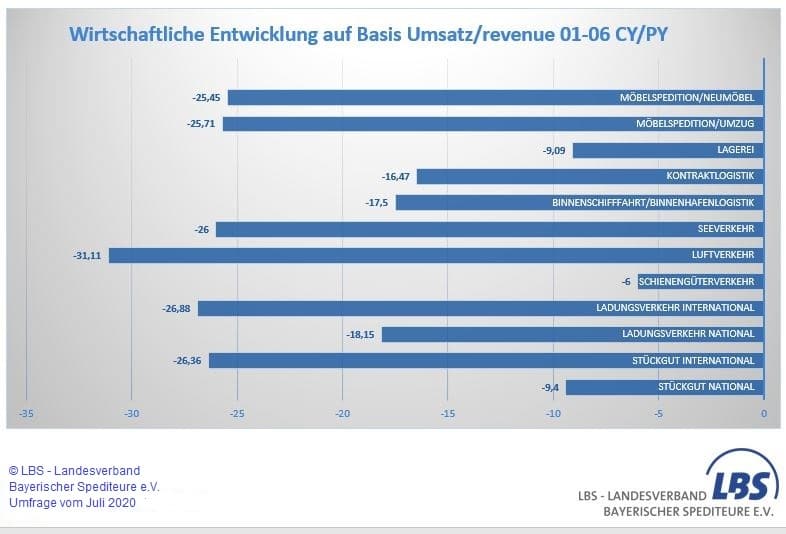

29. July 2020Bavarian freight forwarders draw a meager balance for the first half of 2020. A survey among members shows losses ranging from 9.1 to 26.8 percent, depending on the sector. More than a third of respondents are considering layoffs in the near future. However, there is also optimism for the near future.

(Munich) The result of a current survey by the LBS – State Association of Bavarian Freight Forwarders e.V. among its members shows a heterogeneous reflection of the overall economic development. The majority of companies expect improvements in the second half of the year, but more than a third of respondents are considering layoffs in the near future or have already planned them.

Member companies of the LBS – State Association of Bavarian Freight Forwarders e.V. are reporting revenue declines of up to one third compared to the first half of 2019 due to the pandemic in the same period of 2020. As a recent survey by the LBS shows, the Bavarian companies have been particularly hard hit in air freight (down 31.1 percent), followed by international freight transport (down 26.8 percent) and international piece goods (down 26.4 percent). The smallest declines are recorded in rail transport (down 6 percent), warehousing (down 9.1 percent), and national piece goods (down 9.4 percent).

Across All Sectors of Logistics

The results reflect both the range of services offered by LBS member companies and the degree of impact on freight transport in general: “The massive disruptions of international supply chains, particularly due to the near-total standstill in air traffic, have left very clear marks,” says Henning Mack, Vice President of the LBS. “At an export-oriented location like Bavaria, this was foreseeable, but it could have been much more dramatic. It speaks to the high quality of performance of the companies that they have apparently been able to actively limit the damage.”

In total, the results of this third survey this year confirm what was already evident in the first two opinion polls in April and May. At that time, about one in five companies expected a revenue loss between 10 and 20 percent or between 20 and 30 percent. The high number of companies that still expected revenue losses of 40 percent or more in April had shrunk to about half by May.

Optimism Regarding Liquidity

The assessment of how far companies can manage with existing liquidity has improved over the course of the surveys. The proportion of respondents who indicated “longer than six months” grew from 40 to 60 percent. For other time periods, the proportions decreased accordingly:

- “up to four weeks” from 7 (April) to 3 percent (July),

- “up to two months” from 28.5 (April) to 16.5 percent (July),

- “up to six months” from 25 (April) to 20 percent (July).

Regarding public aid measures, these were rated as “helpful” by a third of respondents in April and May. There were strong fluctuations in other criteria: “helpful and sufficient” was initially named by 11, then 23 percent, while “helpful but not sufficient” was felt by 39, then only 24 percent of respondents. About one in ten companies rated the aid as “not sufficient.”

Majority Sees Improvement in the Second Half of the Year

About 29 percent of the currently surveyed expect that their company’s business will also decline in the second half of the year. Almost 61 percent, on the other hand, are confident that revenues will rise again between July and December. However, only 2 out of 100 respondents expect that the losses from the first half of the year can be compensated in this way. With slight fluctuations, this corresponds to the sentiment of the two previous surveys.

Regarding the employment situation, a differentiated picture emerges. On one hand, 31.1 percent of companies want to reduce the share of short-time work, while on the other hand, 27.4 percent of respondents are considering layoffs. For 6.6 percent of companies, layoffs are already firmly planned for the next three months.

Photo: © Adobe Stock / Graphic © LBS