Swiss Post Completes Acquisition of notime AG

2. September 2020Hapag-Lloyd Introduces Its New Customer Dashboard

2. September 2020“Here we have the salad“ or “number salad“ are word plays with salad. But how does the salad actually get its customs tariff number? This is not a “number salad“, but it has a clear structure, as can be seen from the article in the “Forum Z.“ of the Federal Customs Administration (FCA).

By Yvonne Siemann

(Bern) What actually happens from a customs perspective when a novel product is to be imported? What is the purpose of the tariff number and how is it structured? Forum Z. explains the basics of a complex system.

A few years ago, the new lettuce variety Salanova® was to be introduced into Switzerland. But how do you import a completely new product that has not yet been assigned a tariff number? No import process can proceed without this number. Not only does it define the product in an internationally understandable way, but it also indicates how much customs duty is incurred, whether a product can be imported duty-free, or whether quotas apply. For the importer, this means that they should not make any mistakes in the declaration; otherwise, there may be additional claims and fines.

Furthermore, the tariff number also contributes to the protection of the population. The number indicates whether a potentially dangerous product requires a permit. Free trade agreements as well as the special customs regulations of the COVID2 regulation for the temporarily duty-free import of protective equipment and alcohol-based disinfectants are based on it. Finally, it also contains important information for foreign trade statistics and market observations. Without tariff numbers, rapid global trade in goods would not be possible.

A meaningful combination of numbers

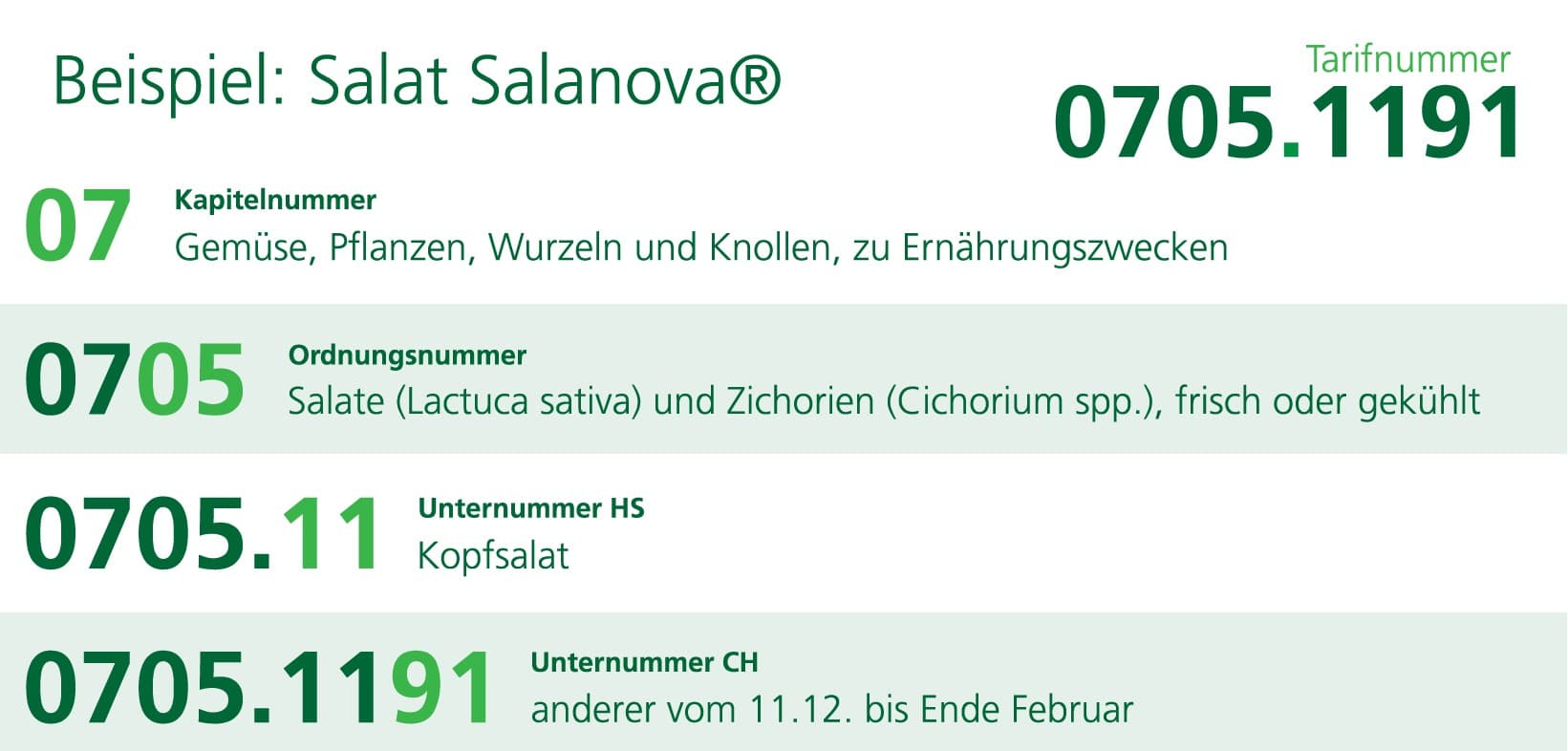

Customs experts cannot simply assign any number to the salad or even invent one. Instead, they must adhere to the “Harmonized System” (HS). This six-digit coding system, established by the World Customs Organization (WCO), has been in effect since 1988. It is divided into 21 sections with a total of 97 chapters. Individual countries or customs areas can add further digits to this code; in Switzerland, there are two. A three-digit “control element/statistical key” can follow, which further defines a product, especially for statistical purposes.

Whereas customs experts used to leaf through thick books, today the digital application Tares is used, which is being further optimized and made more accessible as part of the FCA transformation program DaziT. In case of any uncertainties, there are also detailed explanations for the individual numbers, which specify what characteristics or goods a number includes. Additionally, FCA experts consult further specialized literature, research online, or inquire with other authorities. In doing so, they clarify which characteristics are predominant in order to classify the goods correctly.

Clear number structure

Back to the specific case: Within Chapter 7 (Vegetables, etc.), it was clear that Salanova® falls under the number 0705 (Lettuce and chicory) as a salad. The customs experts decided to classify it as head lettuce based on its external characteristics and the lettuce varieties used for the crossbreeding (sub-number 11). Since it is neither a “Batavia” nor an “iceberg lettuce,” it was classified under the category “other head lettuces,” where quotas may apply depending on the import period, and the last two digits may therefore be 91, 97, or 98.

The tariff classification of Salanova®

Customs experts also need some knowledge of food chemistry when classifying food products. The Federal Institute of Metrology METAS analyzes samples of goods collected from customs offices from specific import shipments to determine parameters such as the exact fat and sugar content, which in turn affects the classification in the sub-numbers and the customs rate.

A changing system

The fact that the new lettuce variety is currently classified under the numbers 0705.1191, .1197, and .1198 depending on the import period does not mean that this will always be the case. Customs tariffs are not a finished system but reflect which goods are significant for the respective export or import economy at a given time. Before World War I, for example, Switzerland had a very finely subdivided tariff for textiles, while food was traded little across borders, and vegetables were correspondingly only roughly classified as “fresh,” “preserved,” and “potatoes.”

Thus, numbers are regularly removed, while others are added at the initiative of trade associations and other organizations. It is not surprising that in recent years, especially in the technology sector, new sub-numbers have emerged. Regarding Swiss sub-numbers, i.e., the seventh and eighth digits of the tariff number, it is not surprising that cheese, chocolate, and machine parts are particularly detailed. For new sub-numbers at the HS level, the respective goods must have a trade volume of at least 50 million USD.

Every five years, a so-called “HS revision” takes place, the next one coming into effect on January 1, 2022. For the revision, representatives of the customs areas meet every five years at the WCO headquarters in Brussels. During the preparatory discussions, every word is sometimes fiercely contested – after all, even an “and” can have significant financial implications. The revised customs tariff is then approved by the Federal Council and Parliament. The HS tariff of the WCO exists in French and English. At the FCA, everything is translated into German and Italian, which involves a lot of effort and is not always easy. In Switzerland, the French version is valid at the Federal Administrative Court – after all, classification decisions are sometimes contested as well.

Photo: © Adobe Stock

Graphic: © Federal Customs Administration (FCA)

With the permission of the editorial team of “Forum Z.” of the Federal Customs Administration (FCA)