LogiMAT 2021 is canceled and postponed to March 2022

27. January 2021Wuunder Offers Innovative Logistics Services for the German Market

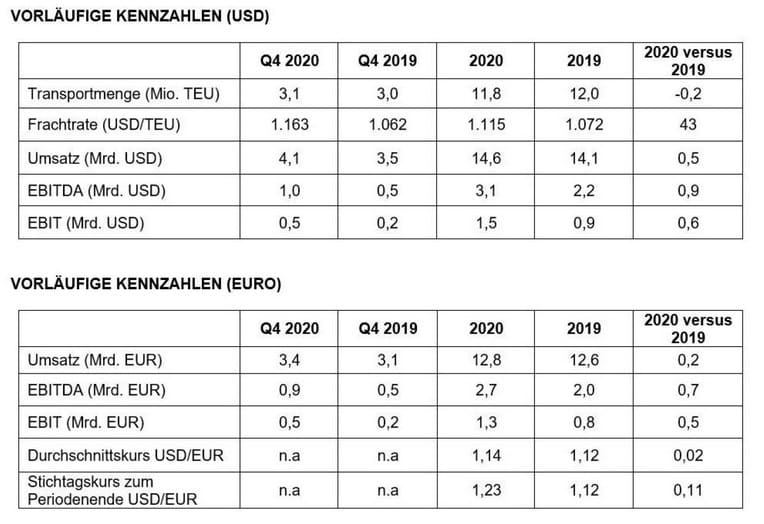

27. January 2021The shipping company Hapag-Lloyd AG has significantly increased its EBITDA and EBIT despite the Coronavirus pandemic. Additionally, freight rates have improved, and transport volumes are slightly below last year’s level. The internal Performance Safeguarding Program has been successfully implemented.

(Hamburg) In the fiscal year 2020, based on preliminary figures, Hapag-Lloyd increased its earnings before interest, taxes, depreciation, and amortization (EBITDA) to over 3 billion US dollars (approximately 2.7 billion euros). Earnings before interest and taxes (EBIT) grew to around 1.5 billion US dollars (approximately 1.3 billion euros). Both figures are within the latest published earnings forecast for the fiscal year 2020. Key drivers of this positive business development were better freight rates and lower bunker prices, as well as cost savings of around 500 million US dollars, thanks to the successful implementation of the Performance Safeguarding Program. The EBIT also includes one-time expenses of approximately 140 million US dollars (about 120 million euros) in the fourth quarter of 2020, primarily resulting from the optimization of the ship portfolio.

Revenues increased in the fiscal year 2020 by about 3 percent to around 14.6 billion US dollars (approximately 12.8 billion euros). This was mainly due to the better average freight rate of 1,115 USD/TEU (2019: 1,072 USD/TEU), while transport volumes at the end of the year were slightly below last year’s level at 11.8 million TEU, down 1.6 percent (2019: 12.0 million TEU).

Hapag-Lloyd will publish the annual report and the audited financial figures for the year 2020, as well as an outlook for the current fiscal year, on March 18, 2021.

Disclaimer Hapag-Lloyd

This announcement contains forward-looking statements that involve a number of risks and uncertainties. Such statements are based on a number of assumptions, estimates, forecasts, or plans that are inherently subject to significant risks, uncertainties, and contingencies. Actual results may differ significantly from the company’s forward-looking statements and expected outcomes.