Mercedes-Benz Trucks Expands Retrofit with Turning Assistants

28. April 2021CIM and Gilgen Logistics Analyze Warehouse Automation

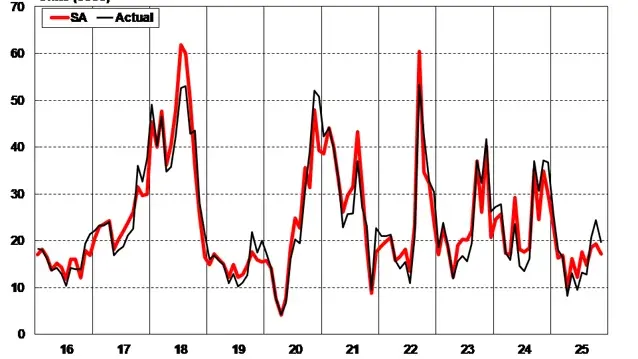

29. April 2021Currently, freight forwarders and logistics companies are not facing liquidity risks from payment defaults, as a representative survey conducted by the DSLV Federal Association of Freight Forwarding and Logistics among its member companies shows. During the ongoing Corona crisis, the Days Sales Outstanding (DSO), which is the number of days from the invoice date to the receipt of payment, has not changed for the logistics industry from a creditor’s perspective.

(Berlin) 78 percent of the surveyed companies indicated that they are currently waiting between 28 and 40 days for their payments. The payment terms are thus roughly at pre-crisis levels. Tendency towards slightly longer terms is observed – independent of the crisis – in the areas of sea and air freight. DSO of 60 to 90 days, as published by credit insurers, are rather exceptions and mostly relate to foreign logistics customers. Sea freight customers from India and the United Arab Emirates are mentioned as negative leaders in this context.

19 percent of the surveyed freight forwarders stated that they were able to actively shorten payment terms during the crisis. To achieve this, companies have strengthened their receivables management and improved their monitoring. Some companies even hired qualified personnel specifically for this purpose. One of several reasons mentioned was the risk provision to protect against payment defaults by ‘zombie companies’, i.e., customers who can delay insolvencies due to the pandemic-related suspension of the application deadline.

Rejecting Bad Payers Among Customers

Other logistics companies are consistently rejecting clients with long payment terms, supported by the currently good order situation, or are permanently ending business relationships with repeatedly late-paying customers. The use of factoring companies to enforce claims or the seizure of goods is only mentioned in isolated cases. About one-third of the freight forwarders feel better positioned today than before the crisis due to optimized accounts receivable and payable management and improved dunning processes.

Only two percent of the DSLV member companies report temporary liquidity shortages during the Corona crisis. When asked about customer groups with particularly poor payment morale, no specific industry was highlighted. According to feedback, there are tendencies towards longer payment terms with increasing size of the client. This also applies, according to some reports, to companies within their own industry. Even if some industrial and trading corporations pressure their logistics service providers in tenders with large transport or storage volumes to accept payment terms of up to three months or more, this is not seen by the respondents as a manifestation of the current pandemic situation, but rather as an expression of the customer’s market power.

Own Payment Terms Remain Unchanged

Freight forwarders also report no changes in their own payment behavior. According to feedback, commissioned transport companies and suppliers are compensated by the surveyed companies on average 30 days after receipt of the invoice. It is also noted that the invoicing by service providers occurs more swiftly than before the crisis.

Photo: © Loginfo24/Adobe Stock