Gruber Logistics Orders 80 Intermodal Trailers from Kögel

15. July 2021DKV Offers Pre-registration for New Polish Toll System

16. July 2021The second quarter of 2021 confirms the upward trend in road freight transport. The TIMOCOM Transport Barometer shows a steady increase in freight inputs in the Smart Logistics System. A look at the balance sheet for the second quarter of 2021 reveals: Freight inputs have more than tripled compared to the second quarter of 2020 and even exceed the values from the same period in 2019.

(Erkrath) The second quarter of 2021 continues the developments of the first quarter: The year had already started well in the first quarter with a 58 percent increase in freight offers compared to the same quarter of the previous year 2020. With a further increase in freight inputs of 51 percent compared to the first quarter of 2021, the second quarter sets new record values in the TIMOCOM freight exchange. Compared to the weak second quarter in the Corona year 2020, this means an increase of 251 percent. Compared to 2019, the year before the pandemic broke out, freight numbers have even doubled.

After the first quarter of 2021, which ended in March with an increase of about 6 million freight inputs more than in the comparison month of 2020, the second quarter has continued to show a significant increase: Since April, more than three times the amount of freight offers has been generated in the Smart Logistics System. The reasons include the reopening of retail and the overall economic development in Europe after the last Corona wave subsided. The manufacturing industry is largely back to full capacity. The economic recovery is also reflected in the Europe-wide shortage of cargo space.

After All-Time High, Small Summer Low in the European Market

The development in numbers: April 2021 saw a moderate increase of 2 percent compared to the already strong month of March. In May, freight inputs rose significantly again by 18 percent. “Here, in addition to the easing of Corona measures, the aftereffects of the Suez Canal blockade play a role. Many goods had to be transported from ports to inland in the weeks that followed,” explains Gunnar Gburek, Company Spokesman of TIMOCOM. “Moreover, the eCommerce business continues to boom. The seasonal decline in June of 5 percent compared to the previous month does not detract from this trend.”

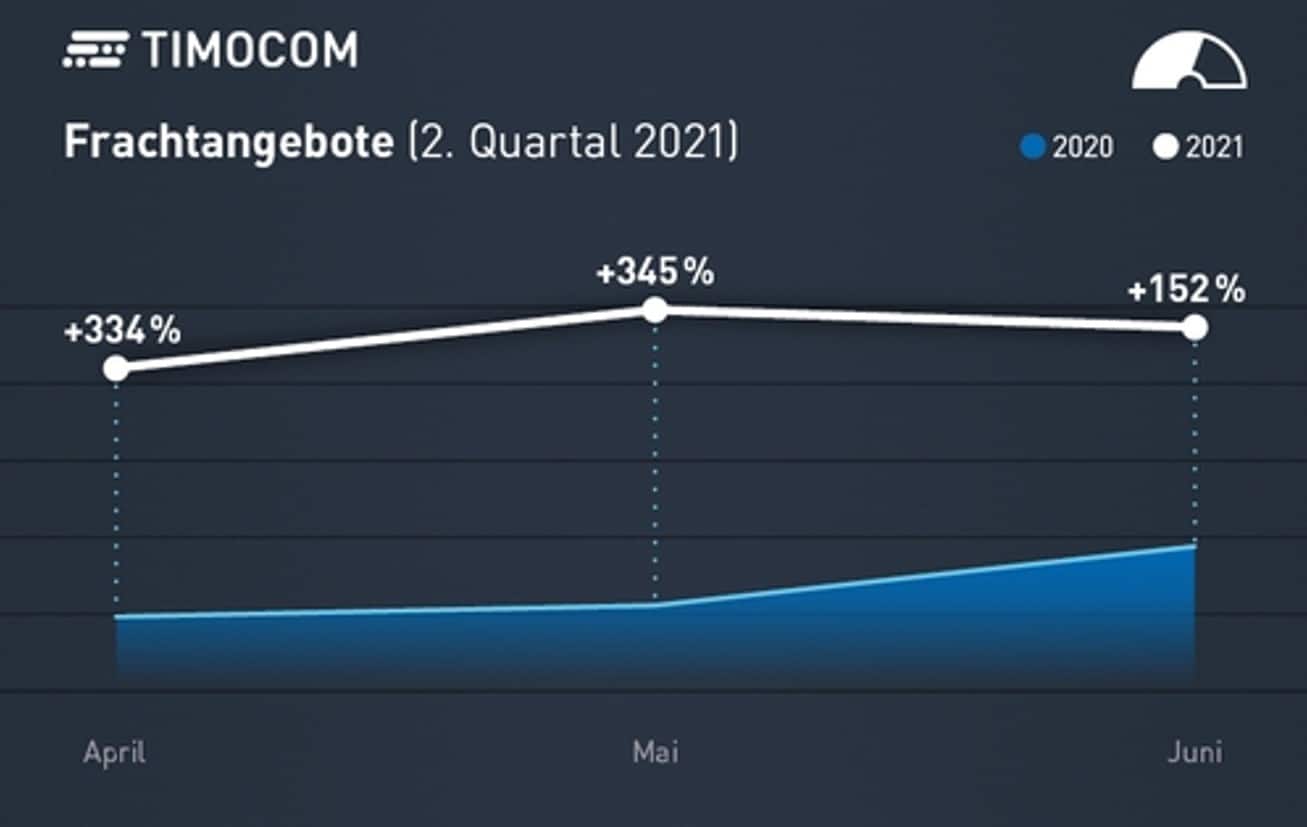

Compared to 2020, which was marked by Corona-related restrictions, new record values emerge in the individual quarterly months of 2021: in April 334 percent, May 345 percent, and June 152 percent.

More Freight, Fewer Trucks

It is also noticeable that there is a strong decline in cargo space inputs. In some cases, declines of up to -25 percent compared to the previous year are recorded. However, this negative trend is a result of the high supply of freight. This means that the possibility of utilizing available cargo space remains very high. Thus, the demand to actively offer cargo space stagnates due to the abundance of offers. This enormous increase in freight inputs is also evident when looking at individual country data.

Pre-Crisis Level Surpassed in Many Markets

In Germany, 69 percent more freight was registered in domestic transport in the second quarter than in the previous quarter of 2021. The slight decline of 4 percent in the first quarter of 2021 compared to the freight boom at the end of 2020 was more than compensated for. The monthly development of domestic transport in the second quarter of 2021 in Germany: in April +2 percent, May +17 percent, and June -5 percent. This development is attributed to the overall economic trend as well as to cargo backlogs due to delayed container ships.

After a decline of 15 percent in 2020, the Dutch market recorded an average increase of 6 percent in the first quarter of 2021. For freight transport, a growth of about 1.5 percent is expected for 2021. Regarding the transport demand in road freight transport, the growth rates are optimistic, suggesting that this estimate will be exceeded. Indicators are provided, for example, by the data of the following country relation: The number of freight inputs with loading location in the Netherlands and destination in Germany increased by 454 percent in the second quarter compared to 2020.

The market in Poland also shows further momentum, although the recovery after the Corona restrictions is progressing somewhat slower compared to the overall European market. The increase in the second quarter of 2021 is lower than that of freight offers in Germany. However, a total increase of 183 percent compared to the same quarter of the previous year was recorded. After the already strong first quarter of 2021 (+30%), the freight volume within Poland increased by 15 percent in the second quarter compared to the first quarter of 2021. The monthly development in detail: The strong March continues in Poland, although there was initially a decrease of 25 percent in April 2021 compared to the previous month. In May and June, the previous months were again exceeded: plus nine percent and plus 16 percent.

France with Highest Increase in Domestic Freight

Freight inputs with loading and destination in France showed the largest increase in domestic transport in the second quarter of 2021 compared to the previous year: an increase of 492 percent in April, 283 percent in May, and another 93 percent in June. The market remained at the high level of the previous quarter between May and June. Even more impressive is the increase in freight from Germany to France compared to 2020. Here, the supply more than tenfold in the first month: 1312 percent in April, 731 percent in May, and again 99 percent in June 2021.

Freight Volume in Spain Above Pre-Crisis Level

The offered freights originating in Spain to the rest of Europe continue to rise overall. In contrast, there is a slight increase in freight from Europe with the destination Spain compared to the first quarter of 2021. Compared to the pre-crisis period, May 2021 stands out with a significant increase, especially in freight offers from Spain to Germany (+104%) and to France (+71%) compared to May 2019. The number of offers for freights from Germany to Spain increased the most in May 2021, with 125 percent compared to 2019. May is a strong month in Spain due to food exports and imports: Compared to 2019, the freight volume overall increased by 80 percent in May 2021. Only the freight offers with destination Romania were declining in the second quarter and fluctuated: April -53 percent, May -12 percent, and June +73 percent.

Photo: © Loginfo24/Adobe Stock

Graphics: © Timocom