New Kühne+Nagel Indicator Shows Disruptions in Sea Freight

20. January 2022

HERE acquires ‘green’ navigation tool from Migros

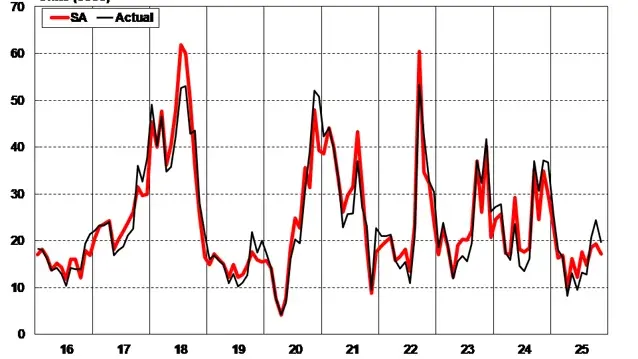

20. January 2022The fourth quarter of 2021 shows a sustained upward trend in freight offers and an imbalance in relation to cargo space availability. The TIMOCOM Transport Barometer continues to report an increase in freight inputs in the Smart Logistics System compared to the previous year. The cumulative data from 46 European countries show a significant increase of 51 percent. The value has also slightly increased compared to Q3.

(Erkrath) Despite intensified Corona measures, the transport market continued to grow in the fourth quarter. From October to December 2021, a total of 9 percent more freight was registered in the TIMOCOM system compared to the previous quarter. November and December were particularly strong months across Europe for freight forwarders and transport companies due to the pre-Christmas business: the volume of freight offers on the spot market in November increased by 88 percent compared to the previous year’s value. In December, freight inputs rose by 52 percent compared to the same month in 2020.

Demand for Transport Capacities in Germany Remains Unbroken

The domestic transport market in Germany generated 18 percent fewer freight offers in October compared to the previous month after an excessively strong September (+60%). However, compared to the already declining third quarter (-18%), freight offers were able to increase by 2 percent. The fourth quarter is thus 37 percent above the same quarter of the previous year. November was also the month with the most freight offers in Q4 in Germany, exceeding the previous year’s level by 87 percent.

The demand for cargo space remains unbroken. Despite supply bottlenecks and delays, cargo space – including for hinterland transports, e.g., from port terminals – is a scarce and highly sought-after commodity. The ratio between freight offers and registered trucks is in imbalance. This development also affects transport prices, as Gunnar Gburek, logistics expert and Head of Business Affairs at TIMOCOM, observes: “Transport prices are under pressure due to rising costs for fuels and vehicle expenses. Additionally, there are now increased personnel costs, CO2 levies, and extra service fees, for example, for unloading and waiting times,” says the company spokesperson. “It is important not to block the scarce capacities in the long term, as unnecessary truck reservations reduce the available cargo space and further increase the market price.”

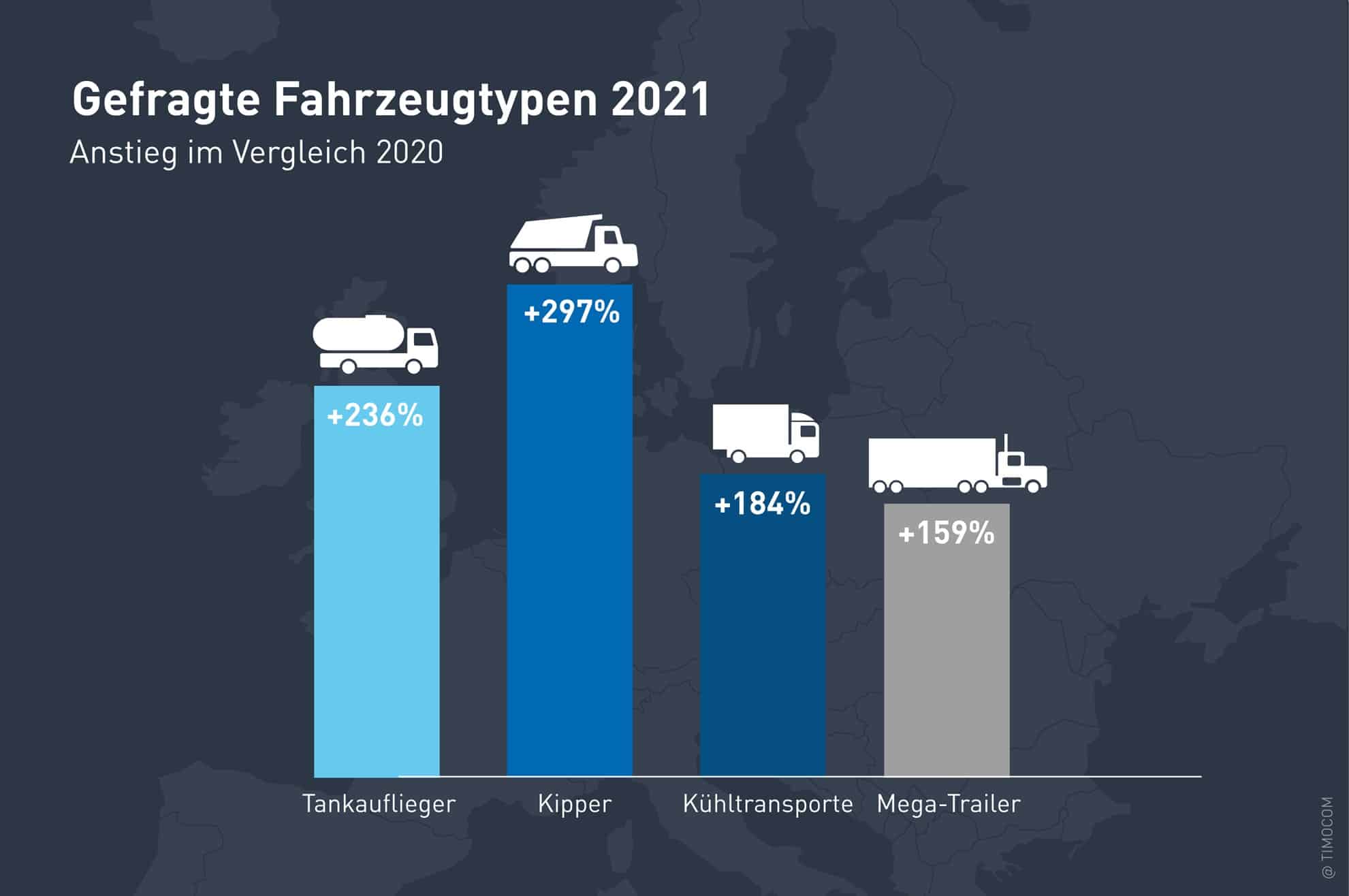

Increase in Tippers, Tank Vehicles, and Mega Trailers

Among the vehicle types, tippers and tank trailers were particularly in demand in 2021 compared to the previous year. For the latter, demand increased by 236 percent, while for tipping trucks, it was an average of 297 percent. Temperature-controlled transports are also in high demand: thermo trucks and refrigerated trailers were requested 184 percent more often. Additionally, jumbo and mega trailers appeared 159 percent more in the offer descriptions than the previous year. Trailers with adjustable roofs, which were little noticed in 2020, even increased by more than 90 times. This is a sign, among other things, that clients are trying to cover as many goods as possible with one transport. A trend that could continue in 2022.

Country Relations in Comparison: UK Flops After Brexit in Lockdown

Among the largest declines in freight offers compared to the previous year within European road freight transport are all routes to and from the UK:

- DE => UK: October -18%, November -16%, and December -48%

Freight offers from France to the island have also decreased:

- FR => UK: in October -4%, in November -12%, and in December -33%

Freights from the UK to Germany fell by 11 percent in October but increased by 25 percent in November before plummeting again by 57 percent in December.

- UK => DE: October -11%, in November +25%, in December -57%

The spread of the Omicron variant of the coronavirus and the renewed lockdown, as well as Brexit and changed customs regulations, are the causes of this development.

More Freights In and To France

Positive developments compared to 2020 can be observed for freights in and to France. According to the European Commission, France’s GDP grew by 6.5 percent, stronger than the European average of 5.9 percent. This dynamic is also reflected in the increase in domestic transport:

- FR => FR: October +39%, November +101%, and December +70%

Freight offers from Germany to France also increased:

- DE => FR: October +19%, November +99%, and December +75%

Significant Increase in Transport from the Netherlands

Freights originating from the Netherlands to neighboring Germany also continued to rise. In November, the Netherlands was declared a high-risk area due to the spread of the Omicron variant. A renewed lockdown followed in December. This led to additional transports and an increased flow of goods into the neighboring country in Q4.

Specifically, the following changes were measured in the fourth quarter of 2021 compared to the same quarter of the previous year:

- NL => DE: October +61%, November +258%, and December +97%

Polish Transport Market Declining at Year-End

In Poland, the total of national transports decreased in the fourth quarter. Although the ratio of freight to cargo space was 36 percent above the fourth quarter of 2020, freight offers in Q4 fell by 12 percent compared to the previous quarter. One reason, in addition to the economic development across Europe, is the situation at the Polish-Belarusian border. Due to the migration conflict, there were days-long closures and truck traffic jams on both sides of the border.

However, the Christmas and year-end business still had an impact in Poland: after a decline of 4 percent in October, the transport market was able to increase by 21 percent in November compared to the previous month. However, the increase was not enough for a turnaround in Polish domestic traffic despite the Christmas business. A similar development was observed in the previous year, which raises hopes for a positive development in 2022.

Review of 2021 and Outlook for 2022

Overall, the recovery of European road freight transport, which began in the second half of 2020, continued in 2021. However, the past year was still characterized by capacity and supply bottlenecks as a consequence of the pandemic. Not least due to the glaring driver shortage in Europe. Additionally, inflation and rising costs for raw materials and fuel were factors. These aspects will continue to concern logistics in the new year. Nevertheless, logistics expert Gunnar Gburek, Head of Business Affairs at TIMOCOM, does not see supply security at risk. However, there may be further delivery delays across Europe. “In road freight transport, especially special transports, such as refrigerated transports, may not always be available at short notice. For standard transports, there is more chance of finding something on the spot market,” says Gunnar Gburek. “The capacities are scarce but available. Digital applications can help optimize the availability of cargo space.”

With the Transport Barometer, the FreightTech company TIMOCOM has been analyzing the development of transport offers and demand in the Smart Logistics System integrated freight exchange in 46 European countries since 2009. More than 135,000 users generate up to 800,000 international freight and cargo space offers daily. The system helps over 50,000 TIMOCOM customers achieve their logistical goals smartly, safely, and easily.

Title photo: © Loginfo24/Adobe Stock

Graphics: © TIMOCOM