Köster Builds Logistics Center for ROSSMANN in Burgwedel

Aug 16, 2022 at 6:26 PM

Swiss Post Tightens Its Climate and Energy Goals

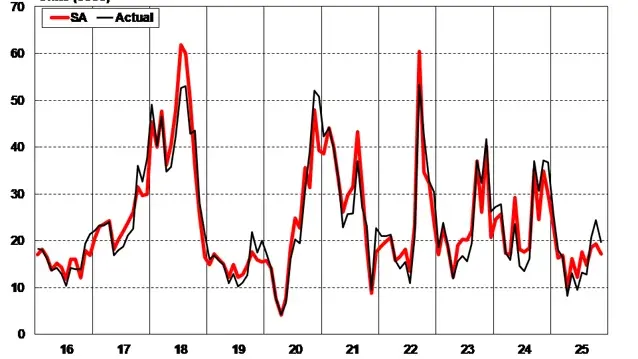

Aug 16, 2022 at 6:52 PMThe parcel shipping market is growing rapidly, and with it, the industry’s demand for swap bodies in which investors can invest through Solvium Capital. The number of shipments across Germany increased by 11.2 percent in 2021 compared to the previous year, reaching 4.51 billion. Since 2019, the year before the pandemic, the number of shipments has risen by nearly one billion.

(Hamburg) Revenue rose by 14.3 percent from 2020 to 2021, reaching 26.9 billion euros, and nearly 11,000 new jobs were created in the industry. This is according to a new study by the Federal Association of Parcel and Express Logistics (BIEK). In the next four years, the association expects an average growth of 5.1 percent per year for parcels.

Swap bodies are used in the KEP industry, among other things, by parcel service providers for the transport of shipments between logistics and distribution centers, wholesale companies, and, for example, electronics retailers. Swap bodies were developed in the early 1970s by the German freight forwarder Dachser for European standards. The base area is adapted to the dimensions of Euro pallets. Accordingly, swap bodies are primarily used in Germany and neighboring countries for mail order. The Hamburg specialist for logistics equipment, Solvium Capital, has been selling swap bodies as investment assets and alternative investment funds (AIF) since 2014 and is also satisfied with the developments in the swap body market.

Higher Rents and Longer Terms

Solvium’s Managing Director Jürgen Kessler: “The already high demand for swap bodies has increased even further in the past two years due to the pandemic. This has had and continues to have a positive impact on rents and achievable returns. In new contracts, we can not only achieve higher rents but also extend the contract terms. Contracts with a duration of ten years are no longer uncommon. In recent years, there have been no rental defaults; this confirms our good risk management.”

“We also expect increasing demand in the future because combined transport will be expanded to reduce the CO2 emissions of transport. Combined transport means that containers and swap bodies will be transported more by rail and less by truck in the future. This can save up to 80% of greenhouse gas CO2,” says Solvium’s Managing Director Andre Wreth.

Most Investment in Standard Containers

Currently, Solvium is offering the investment asset Logistics Opportunities No. 4 for distribution. The offer plans to invest 50.5% in 20-foot and 40-foot high-cube standard containers, 36% in swap bodies, and 13.5% in standard tank containers.

© Solvium Capital/Christoph Ruhland

The base interest rate is 4.40 percent per year with monthly interest payments. By utilizing additional options, bonus interest can increase the yield to up to 4.81 percent annually. The regular interest term is 3 years; upon request, investors can extend it twice by 24 months each. In this case, the base interest rate rises to 4.55 percent per year. Further bonus payments are also possible during the extension. Investors who wish to access their capital early can transfer the contract to the provider after 24 months without giving reasons.

No Investment Recommendation

This is purely a press release and not an investment recommendation. Investing in containers and swap bodies is an area of the supply chain that is not visible at first glance. However, financing is crucial for the availability of sufficient loading units at sea and on the road.

Title photo: © Solvium Capital/Stefanie Müller-Thies