Avison Young Sees Changed Location Decisions Due to Climate

14. July 2023

Panattoni Acquires 62,000 m² Site in Cologne

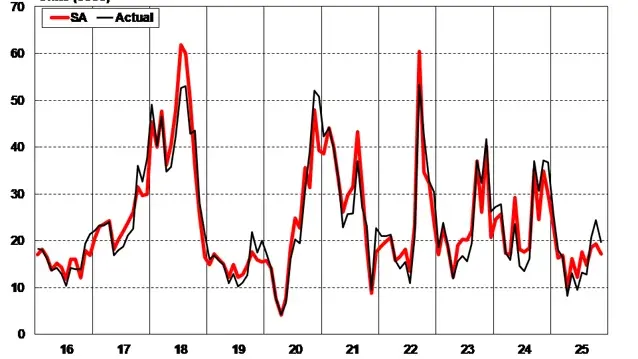

18. July 2023The European transport market moved at a lower level in the first half of 2023 compared to the previous year and is below the values of the pre-Corona year 2019. After the last two extraordinary years, which were still shaped by the pandemic and catch-up effects, road freight transport has calmed down significantly overall. In Q2 2023, there were on average 46.3% fewer freight offers available on the spot market across Europe than in the same quarter of the previous year. Within Germany, there were even an average of 59% fewer offers. The freight price per kilometer was on average 14.1% lower in Europe in the second quarter compared to the same quarter of the previous year.

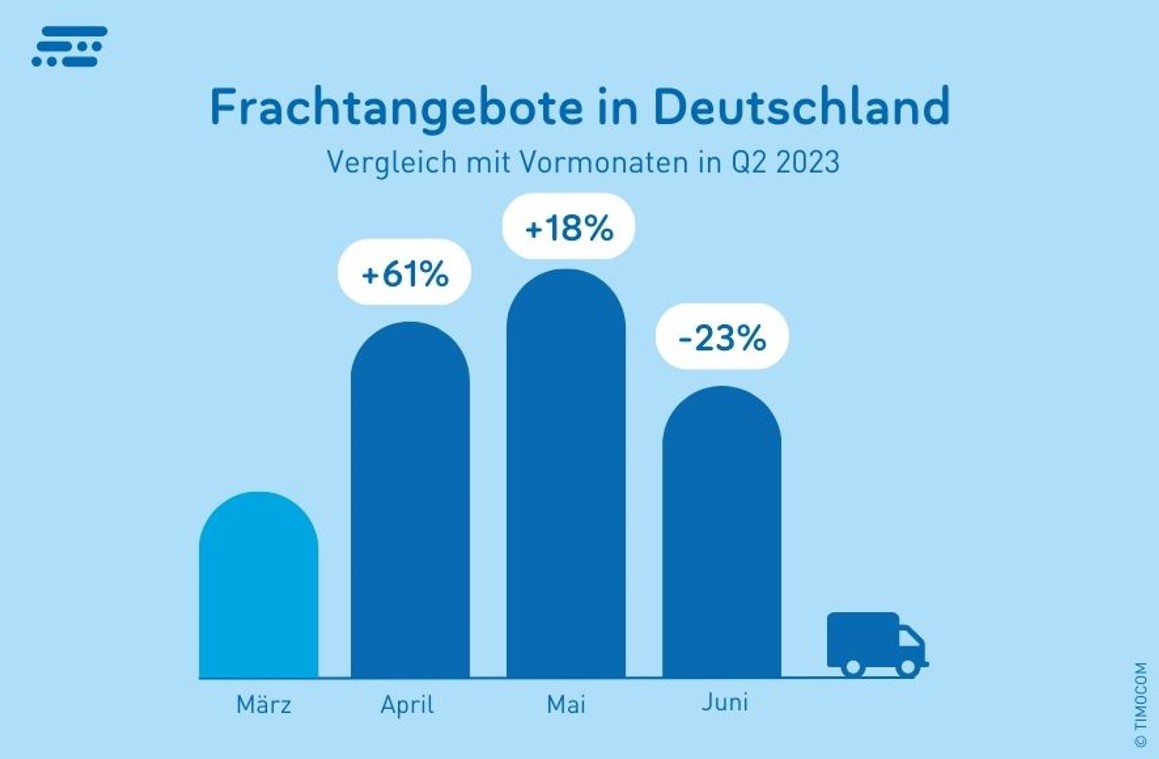

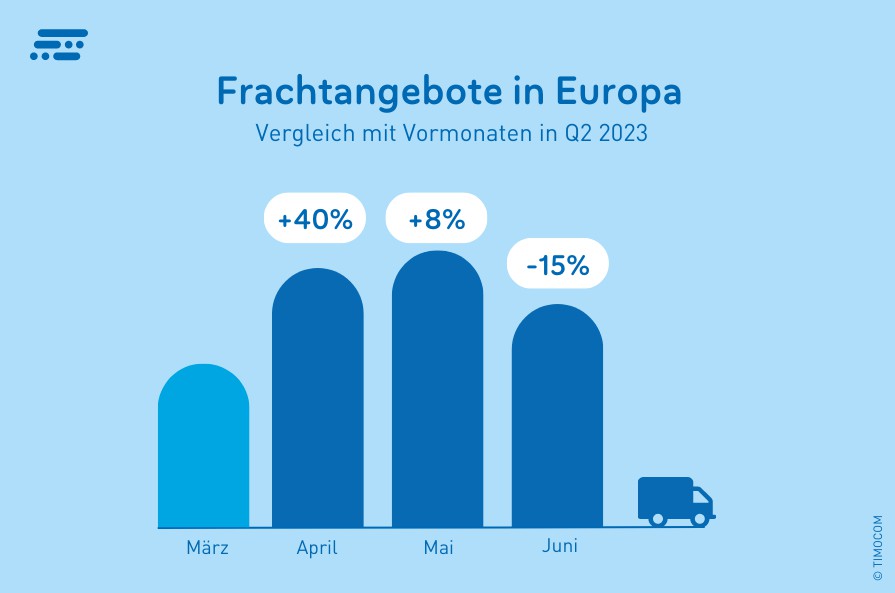

(Erkrath) After a weak start in the first quarter, an increase in transport demand initially emerged in the second quarter. Contrary to the declining business climate according to the ifo index, there were 40% more freight offers across Europe and 61% more freight offers in Germany on the spot market in April compared to March 2023. In May, Germany saw an additional 18% more freight offers compared to the previous month, while Europe as a whole experienced an increase of 8%. Overall, due to the peak at the beginning of Q2, there were 57% more freight offers on the TIMOCOM marketplace than in the previous quarter.

The significant increase in freight offers in the second quarter is partly due to seasonal business. “The months of April and May have been the strongest months in terms of freight offers this year due to the special challenges of the shortened holiday weeks,” explains Gunnar Gburek, Head of Business Affairs at TIMOCOM.

Weak Relations Due to Declining Exports

Weak Relations Due to Declining Exports

Overall, imports and exports in the Eurozone are declining, with Germany’s imports and exports falling according to the Federal Statistical Office. The economy is weakening in Europe, which is clearly reflected in the TIMOCOM transport barometer. Significant declines were again measured in the relations Germany-France (DE-FR -53%) and France-Germany (FR-DE -64%) compared to the same quarter of the previous year. There were also 56% fewer offers from Belgium to Germany. From the Netherlands, there were 40% fewer freight offers destined for Germany (NL-DE -40%). Additionally, there was a decrease in transports from the Federal Republic to Belgium, the Netherlands, Italy, and the Czech Republic.

Although the Kiel Institute for the World Economy (IfW) expects a decrease of 0.3 percent compared to the previous year instead of the previously forecasted increase of 0.5 percent in spring, it still anticipates moderate growth in the German economy in the further course of the year after a weak winter half-year. Indeed, in Q2 compared to Q1 2023, clear increases in freight offers can be noted on many country relations, including from and to Belgium as well as from and to the Netherlands and Italy.

Inconsistent Trend in Domestic Transport Developments

Inconsistent Trend in Domestic Transport Developments

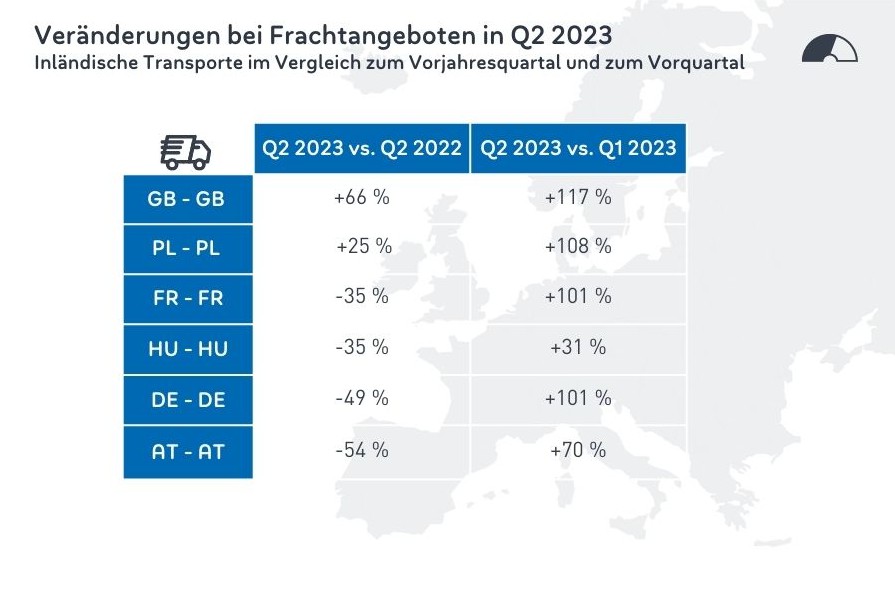

While the UK and Poland were able to significantly increase their demand for domestic transports, the development in Germany, France, Austria, and Hungary was declining compared to the second quarter of 2022. However, compared to the first quarter of 2023, there were clear increases in freight offers. One reason: While France and Germany had extraordinary increases in freight offers in the second quarter of 2022 due to the catch-up effect from the Corona period, these were not as pronounced in the UK and Poland at that time. Therefore, increases of 66% and 25% compared to the same quarter of the previous year could now be achieved. In domestic transports in Austria (AT-AT -54%) and Germany (DE-DE -49%) as well as in France (FR-FR -35%) and Hungary (HU-HU -35%), despite the increases in Q2 2023 compared to the first quarter, the extraordinary values of the previous year could not be reached again.

Summer Slump in Sight: Downward Trend Since June

Summer Slump in Sight: Downward Trend Since June

Since June, a downward trend in the number of freight offers has been observed across Europe due to the traditionally weak summer months, which also coincide with a cooling economy. In June, freight inputs fell by 15% across Europe compared to the previous month.

Interestingly, the offers for loading space did not increase during this period but decreased by 10% compared to the previous year’s value and by 29% compared to the previous quarter. The declining economy is affecting the spot market on both sides, both on freight offers and loading space offers. “Freight carriers offered their services again through traditional sales channels or, due to a lack of prospects for success, made fewer capacities available to the market,” says Gunnar Gburek from numerous conversations with freight forwarders. The participation of service providers in tenders has decreased in the second quarter compared to Q1 2023: 45% fewer bids with a nearly constant number of tenders for regular transports could be explained by the higher capacity demand in the spot market.

Hope for an Upward Trend in the Second Half of the Year

There remains hope that the economy will pick up again in the second half of the year. The transport industry has the experience to deal with challenging situations. “Professional drivers and dispatchers have been under significant pressure in recent years and have been operating at full throttle. Therefore, they can slow down during the less turbulent summer months,” says Gunnar Gburek. “By autumn at the latest, transport capacities are expected to be increasingly in demand and trucks will be back in use.”

Grafiken: © TIMOCOM