HGK Inaugurates New Company Headquarters in Cologne-Niehl

17. October 2023

BGL Sees Toll Doubling as Tax Increase

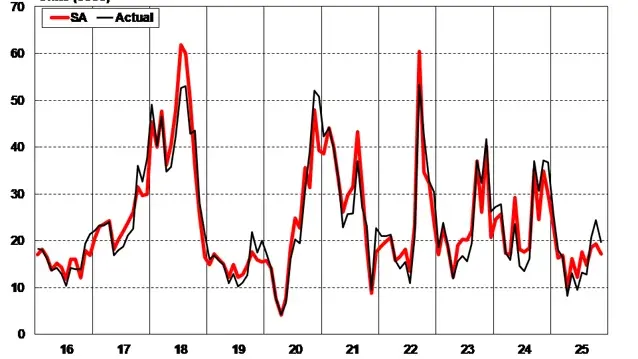

18. October 2023Overall, freight offers according to the TIMOCOM Transport Barometer in Q3 2023 were 21% below the previous year’s value. The ratio of freight to cargo space is approaching the pre-Corona values of 2019. The increased transport demand in September led to a rise in the average freight price.

(Erkrath) The TIMOCOM Transport Barometer showed exceptionally low and high values during the Corona years. This year, it has stabilized again at the level of 2019. Despite a slight recovery compared to previous quarters, the transport market continues to struggle.

After freight offers across Europe were significantly below the previous year’s values in the first two quarters of this year (Q1 -51%; Q2 -46.3%), the gap was reduced in the third quarter but still amounted to 21%. September was the month with the most freight offers in this quarter, yet it was still 13% below the previous year’s value compared to September 2022. The number of offers within Germany in Q3 was even 32% lower than in the same quarter last year.

The demand for transport capacities increased as expected after the summer break. In September, there was a noticeable increase in transport demand on the TIMOCOM marketplace: 46% more freight offers were generated across Europe compared to August. In Germany, there were 57% more offers. The ratio of freight to cargo space in Europe was 64 to 36 in July, 57 to 43 in August, and consequently less balanced at 69 to 31 in September.

Economic Development Pressures Demand in the Transport Market

Despite declining inflation, the weakening economy continues to put pressure on the transport sector. One reason is the glaring weakness in the construction sector, which negatively affects the order situation for transport companies. Additionally, the cautious consumer behavior and lack of investments in many areas are plausible reasons why the previous year’s values could not be reached – both in the private sector, as indicated by the GfK Consumer Climate Index, and in the commercial environment. This is confirmed by the ifo Business Climate Index, which fell from 87.4 to 85.7 over the past three months, even though expectations among respondents improved slightly in September.

Retail is suffering from this development. According to the Federal Statistical Office, sales fell by 1.2% in real terms in August 2023 compared to the previous month. Compared to the previous year, the decline was even 2.3%. According to the Consumer Price Index, food prices rose disproportionately by 9.0%, keeping the inflation rate high along with energy prices.

“Due to the economic development, there was an overall low demand for cargo space in Europe compared to 2022, even though there was a slight increase in freight offer numbers last month,” said Gunnar Gburek, Head of Business Affairs at TIMOCOM. “The transport market in Germany is acting cautiously and reflects the overall economic development. The main reasons are the weak foreign demand and the domestic economic situation.” It is not expected that there will be a significant increase in transport demand this year, Gburek added. “If the transport market continues to develop at the level of 2019, the demand for cargo space will decline again in Q4 2023. This seems realistic given the economic situation in Europe and especially in Germany.”

Average Freight Price Reaches Yearly High

Following the increase in freight offers, the average freight price per kilometer rose by 6.5% in September compared to the previous month. Overall, this value is even 21.3% above this year’s low in February. Despite this increase over the year, all prices are still significantly below the peak values of 2022, when demand was much higher.

More Freight Offers from and to Sweden

Notable changes in freight offers were particularly evident in the relation between Germany and Sweden. Especially offers from Germany to Sweden increased by 70% compared to the same quarter last year. From Sweden to the Federal Republic, there were still 38% more freight offers. Sweden’s export goods include vehicles, wood products, and pharmaceutical products, as well as iron and steel. In terms of goods import, Germany is Sweden’s number one trading partner. For exports, Germany ranks second after Norway, as reported by the German-Swedish Chamber of Commerce. Both imports and exports have also exceeded the trade figures of the pre-Corona level. Germany primarily imports machines and pharmaceuticals.

Decreased Demand for Transports to Switzerland

On numerous routes towards Switzerland, the demand for transport capacities decreased in Q3, despite the disruption of rail traffic due to the Gotthard Tunnel, which had expected an increase in road freight transport. For example, there were 55% fewer freight offers from Austria to Switzerland, and from France towards Helvetia, there were 51% fewer freights than in the previous quarter. From Germany to Switzerland, there were 42% fewer offers than last year, and from Italy, there were 29% fewer freight offers. Due to the rail connection that is expected to remain closed for several months, an increase in road freight transport around Switzerland is anticipated in the fourth quarter.

Decline in Freight Offers from France and Benelux to Germany

Freight offers from Belgium and the Netherlands to Germany also declined (BE-DE -52%; NL-DE -25%). One reason is the declining hinterland transport from the seaports. Container handling in the ZARA ports has been continuously decreasing since the beginning of the year.

Photo: © TIMOCOM