RS-Systems with First Transparent Reusable Load Securing System

Nov 28, 2023 at 9:13 PM

Hellmann Measures Emissions with the Help of Shipzero

Nov 30, 2023 at 6:32 PMAccording to the European Freight Alliance of International Forwarders (ELVIS) AG, the upcoming turn of the year also marks the proverbial hour of truth for the German transport industry. Companies that fail to fully pass on the massively increasing toll costs, effective December 1, to transport prices risk financial losses of a potentially existential nature. The industry can only hope for a positive turnaround next year. This is the conclusion of the current market report from the alliance.

(Alzenau) “With the increase in tolls, the federal government has decided on nothing less than a hidden tax and simultaneously designated the forwarders and carriers as its collectors,” says Nikolja Grabowski, board member of ELVIS AG. “Whether the industry can pass on the immense cost increases seems to be of secondary interest to the coalition.”

Moreover, at the turn of the year, not only the usage fees for highways and federal roads are increasing. Many trucks will also slip into a higher fee class. At the same time, an additional CO2 surcharge will increase the price of diesel by approximately five to twelve cents per liter. According to ELVIS, this situation is further exacerbated by the still uncertain political framework conditions. As a result of a stagnating overall economy, the willingness to invest remains low. The market report only sees a substantial improvement around the middle of next year. “Especially the emerging interest rate turnaround fuels this hope,” summarizes Grabowski. However, the recent decision of the Federal Court regarding the lack of legal basis for the Climate Transformation Fund could stifle any positive signals in their infancy. “In the end, the industry should almost be glad if the federal government does not further increase the toll during the year to replenish the missing funds in the federal budget,” adds the ELVIS board member.

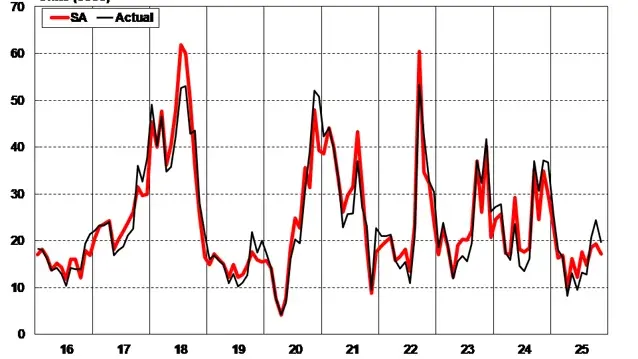

The seasonally typical autumn revival of the transport industry peaked in October, according to the ELVIS report for the past quarter. However, the key figures remained significantly behind the previous year. Accordingly, the business climate is reserved, which is now further clouded by the toll increase. Given the industry-standard thin capital base, the liquidity of companies is now in focus. The toll, alongside diesel costs, is one of the largest items on the expenditure side for forwarders. Its doubling will therefore significantly burden overall payment capacity. “It is particularly noteworthy that fuel and toll providers closely monitor the financial coverage of their customers due to the high invoice amounts. If the invoice exceeds the cost framework corresponding to creditworthiness, it can quickly become tight, and a delivery failure may threaten,” warns Grabowski.

Diverse Recommendations for Forwarders

Against this background, the alliance sees forwarders confronted with the following challenges: First, the additional costs of the toll increase, including all approach kilometers, must be fully passed on to customers. Second, the company’s creditworthiness should be demonstrably verifiable to creditors upon request in the short term. For this purpose, at least the annual financial statement for 2022 should be available. Third, it is advisable to cover larger outstanding amounts through a goods credit insurance or to liquidate them through factoring to increase one’s payment capability. “The importance of solvency is often underestimated. Even passing items can destabilize company finances if they are as large as toll payments,” the ELVIS board reminds and advises forwarders and carriers to pay increased attention to this issue.

Photo: © ELVIS