L.I.T. Group Acquires AUTOTRASPORTI PEDOT in Italy

Jun 4, 2024 at 4:14 PM

Social Innovation Lab “Echo Labs by DACHSER & FERCAM”

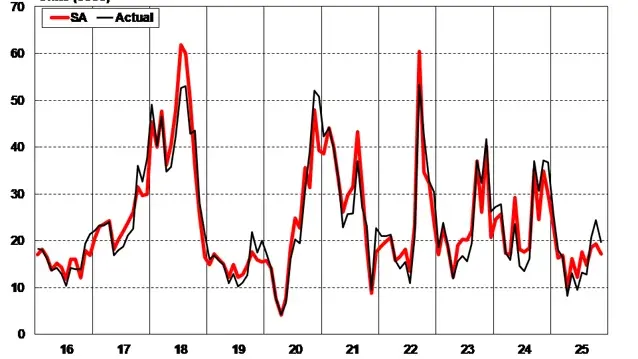

Jun 4, 2024 at 7:16 PMThe European Cargo Alliance of International Forwarders (ELVIS) AG sees initial signs of recovery in the overall economic situation in its presented market report. However, the spring revival is leading to tight cargo space capacities. The increasing number of customer tenders is also putting more pressure on forwarders in the contract business. Additionally, the expansion of the truck toll to 3.5 tons starting July 1 is already casting its shadows ahead.

(Alzenau) ELVIS therefore recommends forwarders and carriers to discuss the impacts with customers. A non-representative survey conducted as part of the market report among ELVIS forwarders shows that companies are looking more optimistically towards the second half of the year.

“After many months of negative reports, it is encouraging that the downward trend has been halted and key figures in the transport sector are rising. The effects of the seasonally typical spring revival are showing initial effects. How sustainable they will be will become visible after the short weeks in May,” says Nikolja Grabowski, board member of ELVIS AG. Despite the first positive signals from the economy, the situation for forwarders remains tense. The supply of cargo space in the market has been reduced in recent weeks and months, leading to tight capacities now. “Unfortunately, the forecasts from the turn of the year have proven to be accurate. Rising customer tenders are putting additional pressure on forwarders,” adds Grabowski.

The implemented spring revival is also reflected in the industrial production figures. Particularly, the chemical industry has made gains both compared to the same month last year (+9.1 percent; March 2023) and compared to the previous month (+2 percent; March 2024). The average of the sectors of chemicals, mechanical engineering, and motor vehicles and parts (+0.5 percent; March 2024) is also slightly positive. The mood among companies is also more optimistic: both the ifo business climate (+1.7 percent), ifo business situation (+0.9 percent), and ifo business expectations (+2.5 percent) in April 2024 show an upward trend compared to the previous month. “This development shows that the trough has been crossed. Although the values are still far behind those from the previous year, the direction is right,” says Grabowski.

For the area of “Goods Transport by Road,” the market report of the forwarding alliance also sees a positive development. The ifo business climate (+15.2 percent) and the ifo business situation (+5.3 percent) have recovered compared to March 2024. This is also reflected in the sales expectations. The ifo economic perspectives for goods transport by road indicate an improvement of 23.5 percent compared to March 2024. However, the market report also shows that the increase is still lagging behind that of previous years. “There are increasing signs of an economic recovery in Germany. In the coming weeks, the spring upswing will typically subside. The further overall economic development will then show at what level summer will stabilize,” says Grabowski.

Slowly but steadily, inflation in Germany has decreased and has now stabilized at a value between two and three percent. At the same time, wage levels in the transport and logistics sector have risen.

Impact of the Truck Toll on 3.5 Tons Unclear

It is currently unclear how the expansion of the truck toll to 3.5 tons will affect the industry. Following the increase on December 1, companies with lighter fleets will also be charged starting July 1. In this context, the market report anticipates tight availability of additional toll boxes. Fleet operators should take action immediately. At the same time, the impacts need to be calculated, discussed with customers, and factored in.

The complete market report for download

Photo: © ELVIS