HHLA with New Container Cranes at Waltersdorf Port

22. November 2024

Volvo Truck Models FH and FM Achieve Five Stars in NCAP Test

22. November 2024For the current peak season 2024, project44 has identified several trends that are already shaping the season: a sustained increase in imports from China, changing port preferences, and a shift towards local sourcing strategies. The peak season in ocean freight is a critical time for businesses as they prepare for the import of the Christmas shopping season.

(Munich) Traditionally, the peak season lasts from August to October. In recent years, it has already begun in June. This shift towards early planning and ordering processes indicates a desire for resilience. This is likely based on the experience of previous delays due to disruptions caused by COVID-19 and longer transit times resulting from tensions in the Red Sea.

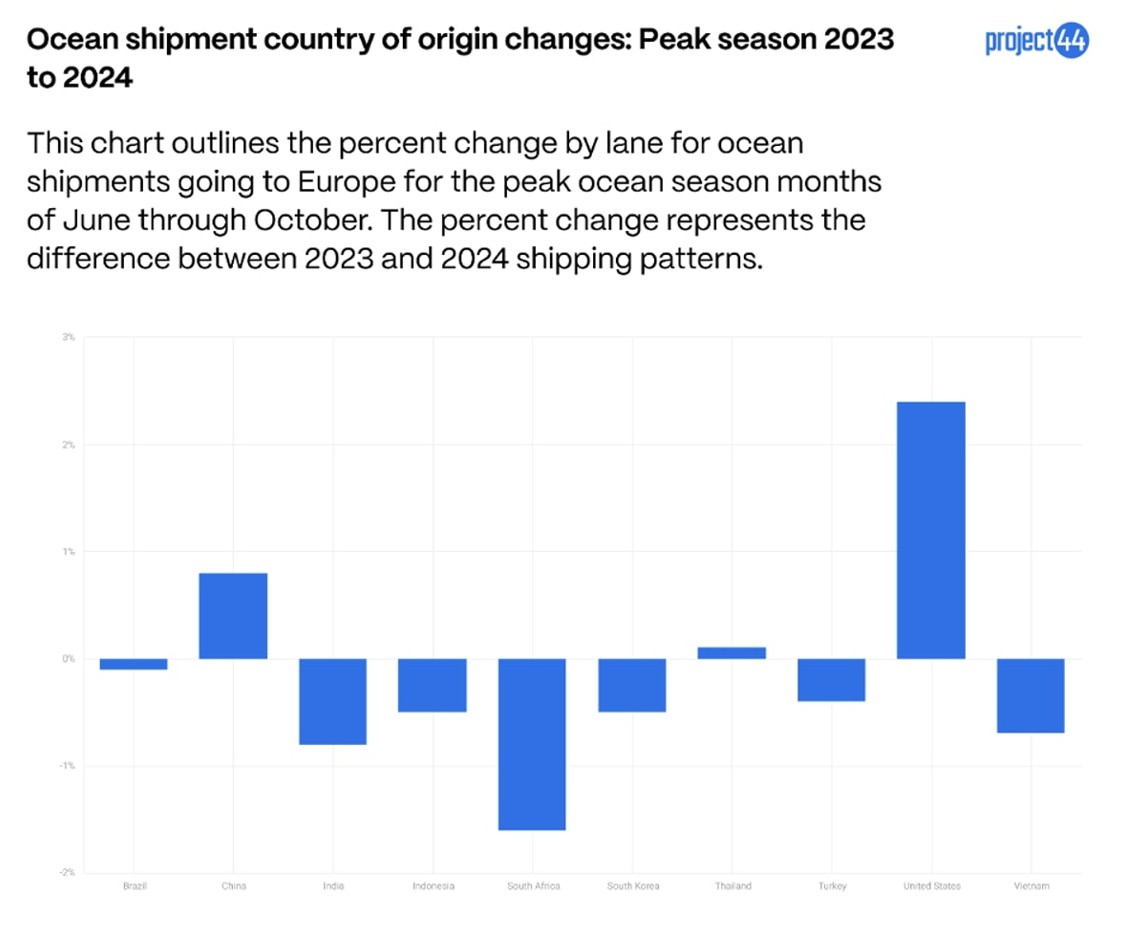

The Most Common Countries of Origin

The figure below (Figure 1) shows the changes in countries of origin from 2023 to 2024. It depicts the goods imported to Europe during the peak season.

China remains a global powerhouse in manufacturing. In both 2023 and 2024, around 44 percent of imports to Europe come from the country. With an increase of less than 1 percent compared to the previous year, Europe is not significantly expanding production and imports from this country. The share of imports from India, Indonesia, South Africa, South Korea, Turkey, and Vietnam has decreased.

The largest increase in import share comes from the United States. In 2024, over 8.5 percent of all European import shipments observed by project44 during the peak season originated from the USA. This represents an increase of 2.5 percent compared to the previous year 2023. This development could be a result of ongoing labor uncertainties in U.S. ports. Although the ILA strike was short-lived, no new contract has been signed yet. Additionally, there is a possibility of another strike in January 2025. This prospect may prompt traders to prioritize imports to stock up and mitigate labor risks.

The largest increase in import share comes from the United States. In 2024, over 8.5 percent of all European import shipments observed by project44 during the peak season originated from the USA. This represents an increase of 2.5 percent compared to the previous year 2023. This development could be a result of ongoing labor uncertainties in U.S. ports. Although the ILA strike was short-lived, no new contract has been signed yet. Additionally, there is a possibility of another strike in January 2025. This prospect may prompt traders to prioritize imports to stock up and mitigate labor risks.

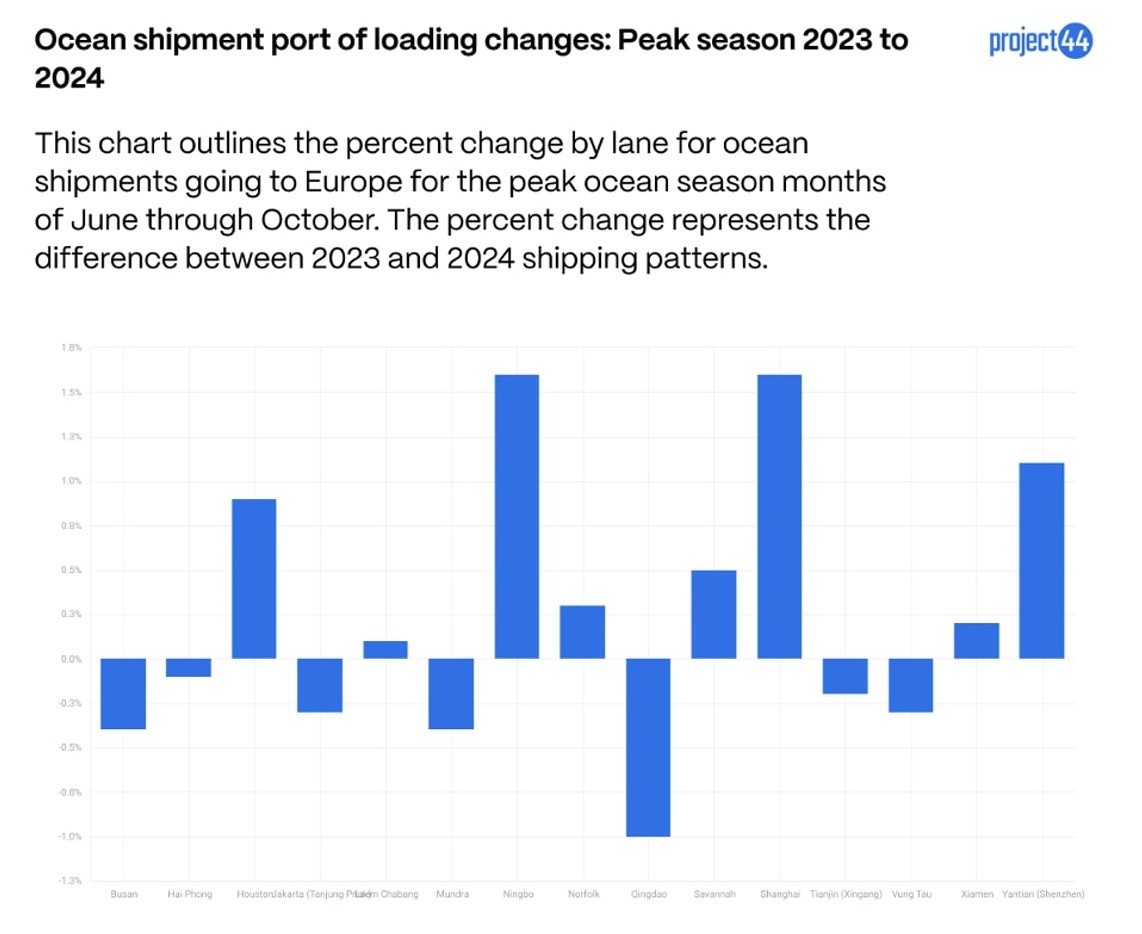

Changes in Loading Ports

The loading port refers to the port where the cargo is loaded onto container ships. The diagram below (Figure 2) shows the development of the main ports used in the peak season 2024 and how their share of peak volume has changed compared to 2023.

Overall, the 15 main loading ports have remained constant. Shanghai and Ningbo recorded the largest increase with a rise of 1.8 percent compared to 2023. Loading volumes from Houston, Norfolk, and Savannah have also increased – despite the labor conflicts and the strike that took place in these ports in October. These three loading ports accounted for 5.6 percent of all shipments to Europe during the peak season.

Overall, the 15 main loading ports have remained constant. Shanghai and Ningbo recorded the largest increase with a rise of 1.8 percent compared to 2023. Loading volumes from Houston, Norfolk, and Savannah have also increased – despite the labor conflicts and the strike that took place in these ports in October. These three loading ports accounted for 5.6 percent of all shipments to Europe during the peak season.

The port of Qingdao saw a 1 percent decrease in exports, indicating that other Chinese ports are being favored over this port. Declines in ports such as Mundra and Tanjung Pelepas highlight the shift in sourcing strategies away from South Asia and Southeast Asia.

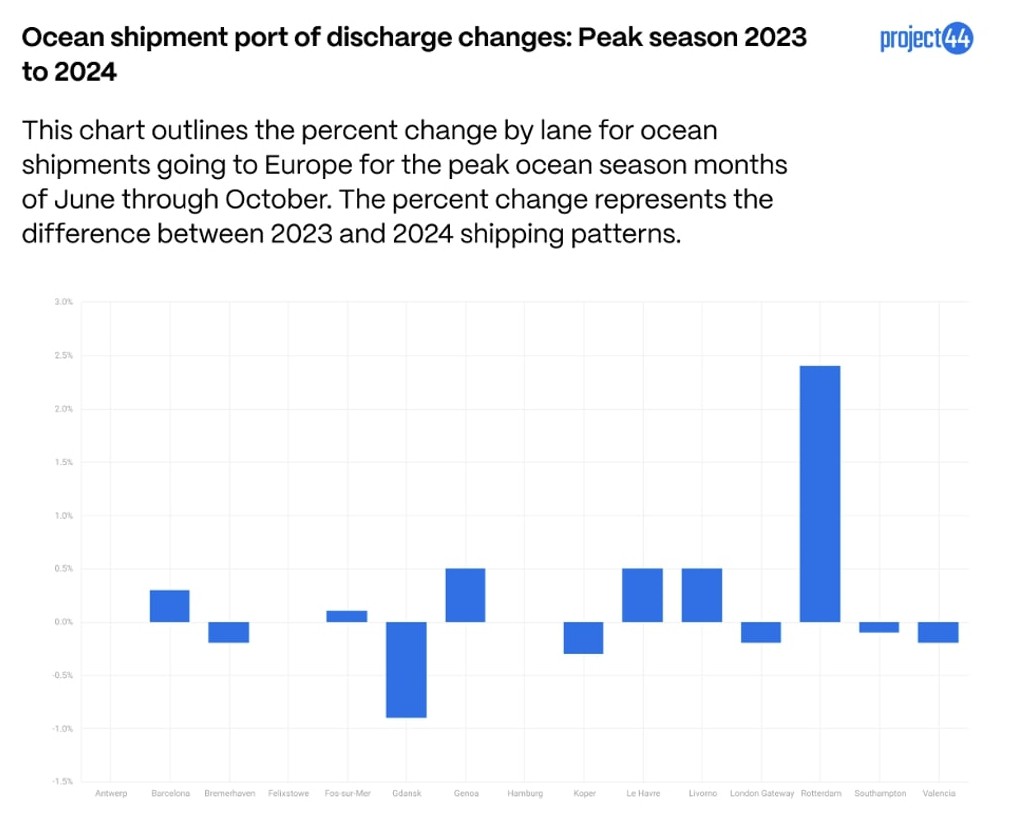

Changes in Unloading Ports

The unloading port refers to the port where the cargo is unloaded from the container ships. The figure below (Figure 3) shows the development of the main ports used in the peak season 2024 – and how their share of peak volume has changed compared to 2023.

Overall, there were no significant changes among the main unloading ports for European imports compared to the previous year. The ports of Rotterdam, Hamburg, Antwerp, and Felixstowe still account for 50 percent of all imports to Europe. Rotterdam recorded the strongest increase of 2.4 percent since 2023, making the port responsible for 20 percent of imports to Europe in the peak season 2024. Gdansk saw the largest decline in volume, but was less than 1 percent below the 2023 figure.

Overall, there were no significant changes among the main unloading ports for European imports compared to the previous year. The ports of Rotterdam, Hamburg, Antwerp, and Felixstowe still account for 50 percent of all imports to Europe. Rotterdam recorded the strongest increase of 2.4 percent since 2023, making the port responsible for 20 percent of imports to Europe in the peak season 2024. Gdansk saw the largest decline in volume, but was less than 1 percent below the 2023 figure.

Summary

The peak season 2024 highlights trends in global shipping and logistics. Despite efforts to diversify production sources, China remains a dominant player. At the same time, the USA is expanding its trade relations with Europe. The ports in Rotterdam and Ningbo have developed into important hubs, while declines in South and Southeast Asian ports reflect changing sourcing strategies. Shippers must continue to leverage real-time data and advanced planning to manage ongoing changes in the supply chain.

Photo: © Loginfo24 / Caption: Ningbo (image) and Shanghai prove to be important loading ports