Federal Minister of Transport Opens Transport Logistic of Superlatives

23. May 2025

Ciblex Digitizes Transport and Logistics Processes with Zetes

27. May 2025The European Cargo Alliance of International Forwarders (ELVIS) AG draws a mixed conclusion in its current market report for the first quarter of 2025: The German economy has still not recovered. While online retail continues to grow and the construction industry slightly benefits from the mild spring, the real estate slump and weak industrial figures lead to ongoing restraint.

(Alzenau) The transport market is experiencing a seasonal upturn, but, as predicted in the previous quarter, quickly reaches its capacity limits. Despite a lack of investment impulses, prices for trucks and semi-trailers are rising, primarily due to the increasing prevalence of expensive electric models. Given the low market buffers, the alliance advises early coordination between forwarders and shippers. Guarantees for cargo space come with additional costs that must also be considered during times of weaker demand.

“The ongoing stagnation of the German economy in the first quarter requires companies to be flexible and plan ahead to remain operational even in difficult times,” says Nikolja Grabowski, CEO of ELVIS AG, regarding the current market situation. The ELVIS market report shows that the German economy was unable to initiate a turnaround in the first quarter of the year. With a GDP increase of only 0.2 percent compared to the previous quarter, economic development remains slightly below the previous year’s level (-0.2 percent). While the construction industry slightly benefited from the mild spring and announced government investments in infrastructure (+2.1 percent) compared to the previous month, the ongoing real estate slump and weak figures from the automotive and chemical industries weigh on the overall economic picture. For instance, the production of chemical products in March 2025 decreased by 2.5 percent compared to the same month last year, while the production of motor vehicles and motor vehicle parts only increased by 1.5 percent.

Internet and Mail Order Trade with Revenue Increase

Only the consumption sector, particularly in internet and mail order trade, shows a revenue increase of 9.5 percent compared to the same month last year. Accordingly, the assessment of companies regarding the current market situation is also cautious: According to the ifo index, the business climate deteriorated by 2.5 percent in April 2025 compared to the same month last year. “This decline clearly signals that the German economy continues to be characterized by great uncertainty,” explains Grabowski.

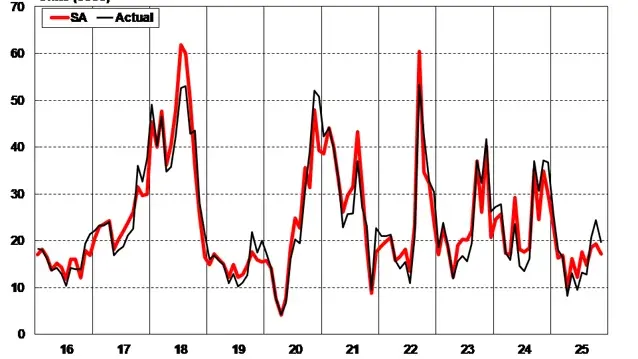

The transport market also presents a mixed picture. On one hand, total mileage in March 2025 increased significantly by 9.4 percent compared to the previous month due to seasonal activity. At the same time, the ratio of freight to available cargo space in the domestic spot market, according to the ELVIS transport barometer, suddenly increased by 22.1 percent in April 2025 compared to the previous month. “These current data from the Easter weeks illustrate how quickly available capacities can be utilized and the market reaches its limits,” summarizes Grabowski. This is accompanied by the dimmed ifo economic outlook for the ‘Goods Transport by Road’ sector.

In particular, business expectations deteriorated significantly in April 2025 – they fell by 30.1 percent compared to the previous month. In a non-representative survey by ELVIS AG, the surveyed forwarding companies appear somewhat more optimistic: About 66.7 percent of them stated that their business expectations for the next four weeks remain unchanged.

Although the willingness to invest among fleet operators remains cautious, vehicle prices continued to rise: by 2.5 percent for trucks and even by 9.4 percent for semi-trailers compared to the same quarter last year. However, this is not due to rising prices for classic diesel trucks: “Given the decline in registration numbers by up to 30 percent, we assume that the increased price indices are primarily due to the high acquisition costs of electric trucks, which drive up the average vehicle price,” explains Grabowski. While prices for classic diesel models remain stable, diesel fuel prices continue to be at a low level: they fell in March 2025 both compared to the previous month (-5.3 percent) and compared to the same month last year (-8.1 percent).

Transport Capacities Quickly Utilized

“The developments of the first quarter confirm our forecasts from previous market reports: Despite moderate volume growth, the available transport capacities were almost immediately utilized. Insolvencies, reduced fleets, and other challenges additionally create low market buffers and complicate the handling of demand peaks,” summarizes Grabowski. A significant expansion of fleets is currently not to be expected given the overall economic situation. “Therefore, early and precise coordination between shippers and forwarders is all the more important – especially in view of seasonal fluctuations and holiday weeks,” says Grabowski and concludes: “If the customer wants cargo space guarantees, they must also be willing to pay for them.”

Photo: © ELVIS