Arvato Supply Chain Opens Another Logistics Center in Spain

20. December 2021

Swisslog Delivers High-Bay Warehouses for SBB’s Rail Technology Center

20. December 2021As part of the spc online event “Development of the Container and RoRo Markets in Shortsea Shipping”, the Institute for Shipping Economics and Logistics (ISL) recently presented the results regarding the market shares of German ports in various sub-markets on behalf of the ShortSeaShipping Inland Waterway Promotion Center (spc).

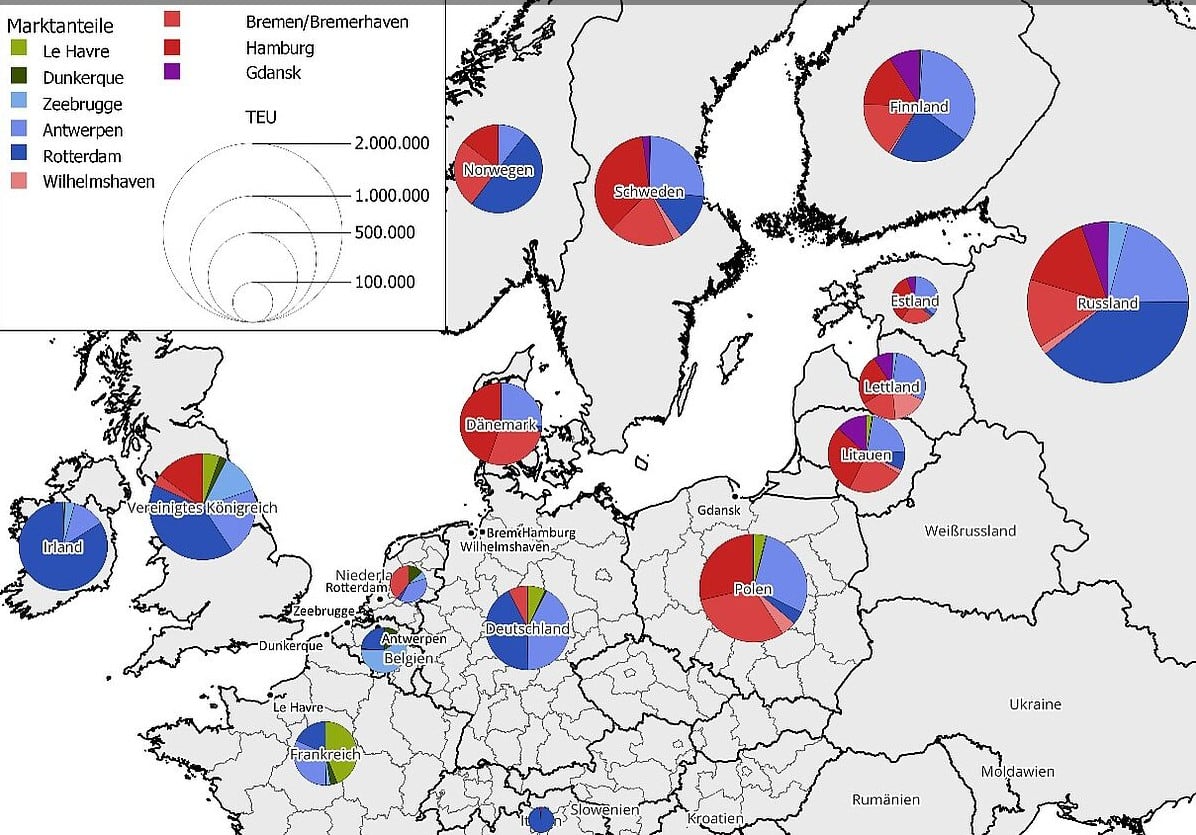

(Bonn) Based on data from the “Container Traffic Model Europe” of ISL, the individual market segments (transshipment and intra-European shortsea traffic, also known as “shortsea-land”) were analyzed by sailing areas. Relevant competitive ports were also taken into account.

One significance of shortsea shipping for spc Managing Director Markus Nölke is that it serves as an alternative to global shipping. Global shipping is without alternatives; there are no shifting potentials once the Silk Road traffic in Asian trade is disregarded. However, these have volume limits. In contrast, shortsea shipping presents itself as an alternative to conventional road freight transport and competes directly with it.

Whether trade with, for example, Asia or America grows, leading to higher transport volumes, or not, the transport sector cannot influence. This also applies to the European market. Nevertheless, there are still potentials that the transport sector can influence due to competition. Every truckload is fundamentally a potential that can be shifted.

And here lies the significant difference for Nölke. “Even in an economic downturn, there remains the possibility of shifting freight to alternative transport modes. Therefore, it is worthwhile to pay high attention to shortsea shipping. This may also coincide with considerations from the industry to relocate production sites to Europe due to supply disruptions in global trade,” Nölke stated in his opening remarks.

“Shortsea shipping can also underscore its importance with strong figures, as more than half of the container handling in German ports depends on shortsea traffic,” said Dr. Sönke Maatsch from the Institute for Shipping Economics and Logistics (ISL).

High Share of Intra-European Container Traffic

In 2020, container traffic with European correspondence regions accounted for 33% of the container handling in German seaports. In hub ports, part of the intercontinental container traffic – namely the share that is attributed to transshipment traffic – depends on these intra-European traffic. When including these traffic, more than half of the container handling in German seaports is dependent on intra-European sea traffic.

In 2020, container traffic from German seaports to European correspondence regions was 4.7 million TEU, slightly below the previous year’s value. It thus proved robust during the Covid-19 pandemic. The declining trend from 2016 to 2020 is not due to negative market growth but primarily to market share losses of the German North Sea ports in feeder traffic to the ports of Rotterdam and Antwerp.

In 2020, approximately 96% of the container traffic between German container ports and European correspondence ports was accounted for by German North Sea ports, primarily in feeder traffic, where German ports act as hubs for transshipment traffic. At the same time, German ports are also “spoke” ports, meaning sources or destinations of transshipment traffic, where other European ports serve as hubs.

The volume of intra-European shortsea-land traffic – that is, the transport of goods between European countries by sea – was nearly one million TEU in 2020. In this market segment, alongside the container ports in the North Sea, German Baltic Sea ports are also active.

Feeder Containers

In feeder traffic, German seaports compete with ports (see Fig. 1) in France, the Netherlands, Belgium, and Poland. The market share of German ports has significantly decreased in recent years from 44% in 2016 to 35% in 2020. While the overall market grew from 7.8 million TEU to 8.9 million TEU during this period, feeder traffic in German North Sea ports declined from 3.4 million TEU to 3.1 million TEU. In both Hamburg and Bremerhaven, the draft restrictions for Asian liner services increasingly limit the cargo volumes. Shipping companies respond by unloading transshipment containers primarily in Rotterdam or Antwerp when coming from Asia. The recent adjustment of the Elbe river and the planned deepening of the Weser could lead to backhaul effects.

The most important transshipment markets for the North Range and Baltic Sea ports are the Baltic Sea region and the British Isles (5.6 million TEU and 1.2 million TEU, respectively). Additionally, traffic within the North Range is significant (0.9 million TEU). The Iberian Peninsula and the Mediterranean region are also partially served through North Range ports.

Despite trade sanctions against Russia, which led to a decline in feeder traffic with Russia, Russia remains the largest feeder market in Europe with 1.6 million TEU. Other feeder markets with a volume of more than 500,000 TEU in the Baltic Sea region include Finland, Sweden, and Poland.

The market share of German ports in transshipment traffic with the Baltic Sea region averages 46%, with particularly high market shares in Denmark, Poland, and Sweden. The leading ports for Finland and Russia are Rotterdam and Antwerp. The Polish port of Gdansk has also established itself as a transshipment hub for Russia, Finland, and the Baltic States, holding a market share of 5% in feeder traffic with correspondence ports in the Baltic Sea region.

The feeder traffic between continental European hub ports and the British Isles had a volume of approximately 1.2 million TEU in 2020. Here, Rotterdam and Antwerp are the leading hubs.

Shortsea-Land

Shortsea-Land

In 2020, 5.9 million TEU were handled in the intra-European shortsea container traffic in the ports considered (see Fig. 2). In this segment, the United Kingdom (2.4 million TEU) and Ireland (0.6 million TEU) are by far the most significant markets, primarily supplied through Rotterdam, Zeebrugge, and Antwerp. German ports play a comparatively minor role here, with a share of 11%. In addition to Hamburg and Bremerhaven, Cuxhaven is also represented with a liner service on this route.

In the shortsea-land traffic with the Baltic Sea region, the western competitive ports hold the largest market share. Of approximately 1.8 million TEU in this market segment, Rotterdam, Antwerp, and Zeebrugge together held 63%, while German ports held 32%. In this market segment, various German Baltic Sea ports – led by Lübeck – are also active. However, there is direct competition with (accompanied and unaccompanied) trailer traffic, which is of far greater importance for the trade between the countries in the Baltic Sea region than container traffic.

Conclusion and Outlook

With a total of 14.7 million TEU, traffic with European correspondence regions is of high importance for the ports of the Le Havre-Gdansk range. When including the handling of overseas liner services associated with the feeder business, even 23.6 million TEU are dependent on intra-European traffic. The feeder and shortsea-land markets exhibit very different market structures, particularly regarding customers and freight carriers. Despite these differences, significant synergies exist between the two segments. Most feeder services between hub ports and European correspondence ports also transport a share of intra-European shortsea-land traffic.

Recent data for 2021 indicate that transshipment and shortsea-land container traffic have largely recovered from the Covid-19 pandemic. While traffic with the UK remains burdened by Brexit, particularly in Baltic Sea traffic, above-average market growth is still expected, offering potentials for German ports in both feeder and shortsea business.

Title photo: © Loginfo24 / Graphic: © spc